DO YOU WANT FINANCIAL INDEPENDENCE AND TO RETIRE EARLY?

Take This Self-Assessment Test And Find Out!

We bring together investors whose pooled resources allow us to invest in bigger and better deals than those available to an individual investor or small group. That means potentially greater returns for you.

It sounds simple enough: Jobs attract people, and people need a place to live. But there’s more research needed to locate the true ‘emerging markets’ with sustained growth and economic vitality. Blue Ring Investors LLC performs extensive due diligence to ensure we are targeting the right properties in the right locations that will generate the healthiest return on your investment dollars.

We are plugged in to an established network of vetted and successful real estate acquisition teams in whose deals we invest for your benefit. We work directly with these teams at the management level to safeguard your investment. And we continue to identify qualified vendors, partners and advisers to give us a competitive advantage as we enter new markets.

A syndicate is defined as a group formed for a common purpose, with the term most commonly used to describe pooling of financial resources to accomplish a stated goal.

In real estate, syndication involves pooling money from investors and sweat equity from the organizers to purchase, rehab, operate, and eventually sell the properties.

As the syndicator, Blue Ring Investors LLC brings together a group of investors from within the medical profession to participate in larger deals with potentially bigger returns than would be accessible to an individual.

Before making an investment decision, each prospective investor gets a Private Placement Memorandum and property overview containing information needed to make an informed investment decision on a particular property. The Offering Package will explain everything we know about the property, including its past and projected financials, its physical condition, its market location, the tenant profile, and the proposed acquisition, operations and exit strategies, and risks of investing.

We target multifamily, senior and student housing assets in emerging markets with strong economic and demographic foundations after careful research and due diligence.

Our primary objective is to acquire, optimize, operate, generate cash flow during ownership, and eventually sell the properties for a profit that we share with our investors.

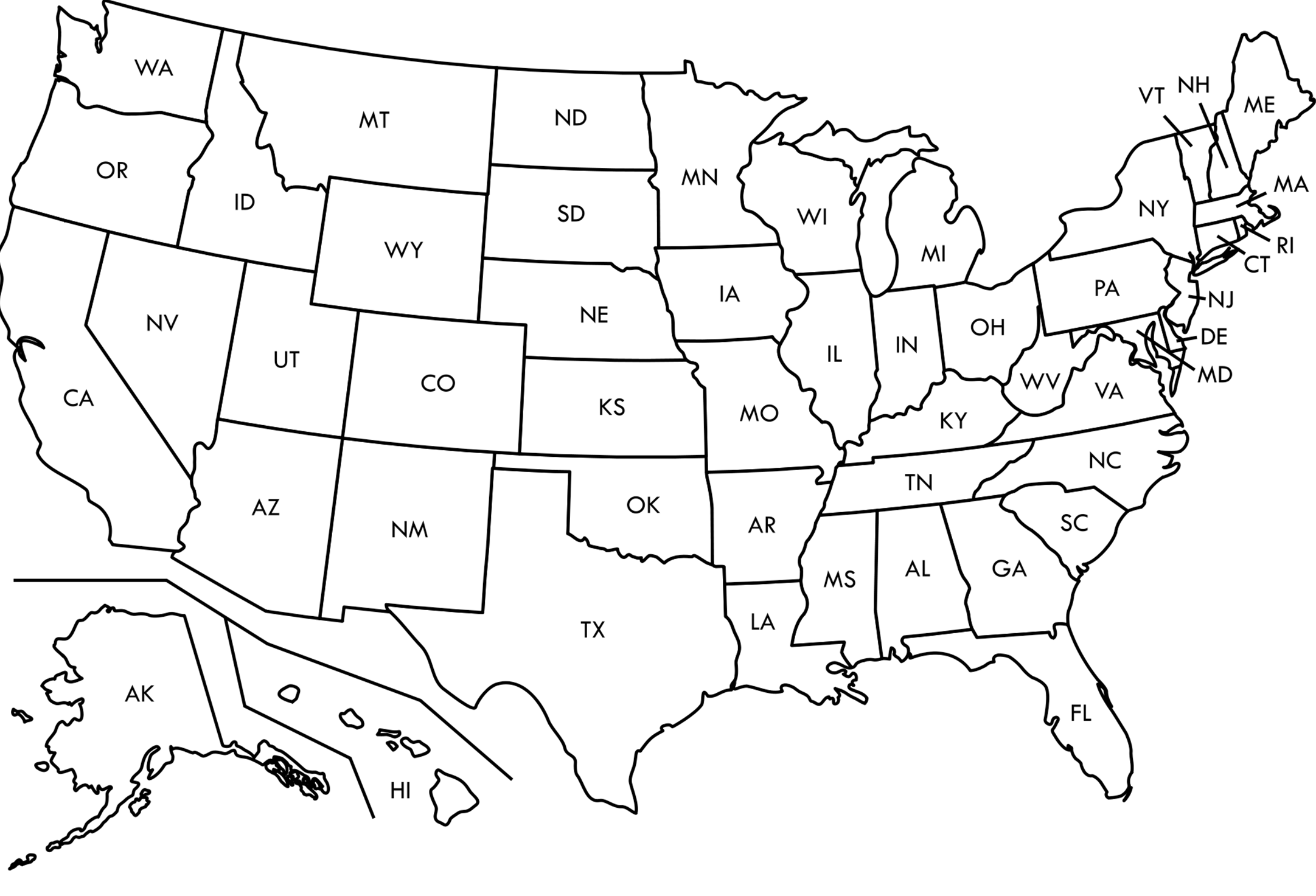

We focus on high-performing multifamily properties, senior housing and student housing in carefully selected emerging markets, primarily in Texas and the Southeast United States.

As a hard-working medical professional you don’t have the time or may not have the ability to invest in commercial real estate on your own. No worries; leave the hard work to us as you watch your retirement portfolio grow.

This is a truly passive investment. You will never have to evict a tenant or fix a toilet, as we will handle all of the day-to-day management activities. As an investor, you will get to share in excess cash flow and equity on eventual re-sale of the property.

COPYRIGHT 2022 © BLUERINGIVEINVESTORS.COM – ALL RIGHTS RESERVED